Credas recently hosted a webinar in partnership with Chronicle Law and compliance experts Arête. The webinar discussed the evolving trends in legal compliance and onboarding practices for law firms as they approach 2025. It emphasized the importance of integrating innovative onboarding methods to meet regulatory demands and ensuring proper compliance to foster trust in client relationships.

Hosted by Rhian Del-Valle from Credas, the webinar featured Kim Rawlings-Smith and Zain Maqsood from Arête who shared key insights on anti-money laundering practices, document verification, and the challenges law firms face in maintaining compliance, while introducing solutions to streamline these processes.

Key takeaways from the webinar

Evolving Legal Compliance Landscape

As the legal landscape rapidly evolves, compliance is no longer just a formality but a cornerstone of trust and efficiency in client relationships. Firms are encouraged to adopt innovative onboarding practices that streamline compliance processes in response to constantly changing regulations.

Importance of Compliance Tools

Despite the growth in the legal sector, recent findings show a decline in compliance among law firms. Only a small percentage of firms were found fully compliant with AML obligations, indicating a significant need for firms to actively integrate compliance tools and practices to fill existing gaps.

Onboarding Individuals and Businesses

Best practices for onboarding not only involve gathering basic client information but also ensuring rigorous anti-money laundering checks and risk assessments are in place. Key points include verifying identities against official documentation and performing comprehensive client risk assessments.

“When I’m reviewing terms of business and client care letters I’m finding that it doesn’t actually cover off the data protection aspects and the anti-money laundering aspects that’s required when you are taking on clients and onboarding them to make them aware of the obligations that are upon you that you have to meet when onboarding a client”

Kim Rawlings-Smith, Arête

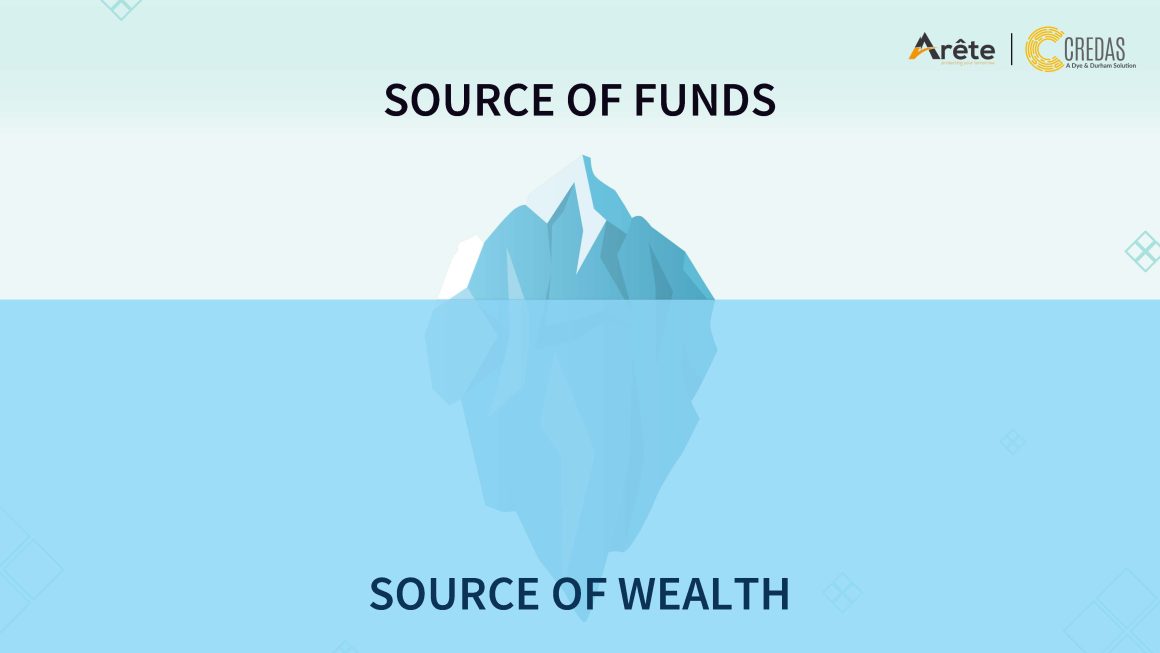

Source of Funds and Source of Wealth

Understanding the difference between Source of Funds and Source of Wealth is essential in compliance. Source of funds pertains to where the transactional money comes from, while source of wealth looks at how an individual has accumulated their wealth over time. It can be viewed almost like an iceberg. The monies used for the specific transaction appear above the surface but underneath there is a far greater mass of wealth from various sources than there first appears.

“Source of Funds is how is the person able to afford the transaction. Say you have a client that’s willing to buy a million-pound house but has an average salary how is it possible it? Does that make sense? Can you see a pattern of how much money they’re putting aside from their salary or dividends or rental” Zain Maqsood, Associate Director, Arête

Risk Assessment and Compliance Measures

Conducting thorough risk assessments is critical for law firms when onboarding clients. This includes evaluating potential risks associated with clients, especially in high-risk countries, and establishing clear protocols on identifying the ultimate beneficial owners in business transactions.

The full recording is available from the Credas website .

Jonathan Bennett

Jonathan Bennett