Times are challenging for law firms. Yet, many bury their heads in the sand or are not proactive enough about actively managing cash. Even the most experienced managing partners in the more savvy firms are looking afresh at old and new ways to improve profit and cashflow (obviously, not the same thing..).

Let’s look at some top tips for improving cash flow quickly and some strategies for boosting profits via (inter alia) better billing.

Quick Wins to Improve Cashflow

1. When did you last increase your hourly rates?

Don’t be put off by the guideline rates. Price appropriately. Don’t reduce prices to compete with your peers – have real differentiators (how are you different and exceptional?) and increase your rates, so that you are competing on your own terms, not theirs, and providing real value to your clients

2. Referral fees

Subject to the rules, you can often make a greater margin by referring work you don’t cover to a friendly firm (who will in turn refer to you), rather than just taking low value work for the sake of it (unless you can scope this properly, do the work at the right level so that it is profitable and charge for extra work).

3. Cash Pinch-Points

Think about your cash pinch-points and the timings of your payments in and out. Move these if you need to by talking to your suppliers and improving your own debt collection terms (I call it debt, not outstanding invoices, as that is what it is: you shouldn’t have any outstanding invoices if you have a proper payment upfront (fixed fees) or monies on account (hourly rates) policy). Invoices should be payable on demand. You may also find it beneficial to move your tax year end date to coincide with your best cash period

4. Client Account Rate

When did you last look at the interest rate on your client account? Some banks offer around 5% – which can make a huge difference to a firm – and yet some firms languish at below 1%

5. Client Debt

- If you are owed a lot of client debt, dedicate one member of staff to call and email debtor clients. If necessary, offer deals to accept a slightly lower sum if they pay immediately – slightly less cash now is better than slightly more later.

- Always charge more if you are waiting for your money

- Bills should be payable on demand. Add interest and chaser costs if clients do not pay immediately

6. Retainers

Define retainers and charge extra. Always scope both estimates and fixed fees properly. For estimates, you must add a ‘cushion’ layer and ensure that estimates are 1) appropriate in the first place; 2) immediately revised if factors come to light which alter it; 3) revise it at any stage if it ceases to be appropriate; 4) update it if you are about to exceed it; 5) give new estimates for new phases of work; and 6) give a brand new estimate for a completely new piece of work. Quick tip: an estimate should only ever cover the first draft of a document or letter, so that updates, further drafts, comments, client comments, revisions, further documents and exchanges are charged extra. If you merely say “estimate to write letter” or “estimate to draft document”, you are setting yourself up for a fall! Second quick tip: always have an over-arching umbrella estimate in place, to protect you at all times in case there is a gap in your estimates

Scope with negative and positive assumptions (“covers x, does not cover y”) and charge extra if over horizontal scope (time or date or time percentage) and vertical scope (size or complexity). For both fixed fees and estimates, do not just take into account the number of hours. Also include value, size, complexity, urgency, how demanding the client is, etc.

7. Leaking Buckets

Do you have ‘leaking buckets’ in your firm? In other words, is money being lost due to complaints, inefficiencies, inactive files (very common), poor debt recovery, lack of billing, etc? Always, every day, consider BCDE: billing, cash, debt and expenses – these are the pillars of financial discipline

8.Billing

- Consider twice-monthly billing to improve cashflow (this also helps clients to budget in eg family law departments). Naturally, you ought to be billing all your WIP monthly anyway unless there is good reason not to do so (eg deferred cases). Law firms have historically possessed a nonsensical notion that “WIP is good as it shows how valuable the firm is.” This is nonsense. You pay tax on it and dead WIP is no good to anyone. All WIP should either be billed or written off each month end (unless on contingent cases)

- ALWAYS take fees upfront (fixed fees) or monies on account (estimates). Reduce the fee if the client pays immediately; increase it if over instalments (you are not a bank!)

- Do deals for clients if they pay everything upfront (and the reverse is true). For instance, a fixed fee of £5,000 paid in full upfront becomes £6,000 if split (one payment of £3,000 now, one later)

- Don’t assume that, for particular types of work, clients can’t pay you until later (eg corporate sales or deferred funding matters): ask for the money anyway and then take a view

9.Pricing

- Are you pricing all your work properly (see above) when compared to the market, the value you are providing to your clients, your overheads and margins and considering that each piece of work must be profitable (otherwise profitable departments and work can mask unprofitable ones)? Split your work types and departments and fee earners out and make sure that these all turn a profit. Indeed, gross profit margin is an even better indicator.

- If you are busy, converting all enquiries and / or have no resistance to your prices, increase them immediately

10. Value of Clients

Don’t forget the enormous value of existing, current and old clients. Check in with your clients and old clients regularly (just to say hello – you’ll be amazed how much work you get), consider a client relationship manager, send newsletters from your database, cross-refer and upsell. One useful exercise is to make a grid with your service areas at the top and your top 25% of clients alongside the side – and look at what areas they have not used you for, then ask them why. I can guarantee that this exercise alone will generate you fees

11. Exceeded Estimated Fee

If you have gone over an estimate or exceeded a fixed fee and are thinking that you’ll have to take it on the chin, try my magic wording. This works almost every time. First, remind the client of the work done and the benefits and value you have delivered to them. Second, say “I’m in your hands, but do you mind if I bill you [a portion of the difference]?” You’ll be surprised

Better billing

I could fill hundreds of pages with tips on how to make more money, but here are just a few (I included some in the first section)

- Undertake a competitor analysis of prices and increase yours. Embed value and differentiators. You are more expensive because you are better. Get your clients to compare apples with apples, not with pears (eg the rock-bottom prices some conveyancing firms charge, but highlight the add-ons and how you stack up when you take your better service into account)

- You want fewer, better-quality, better-paying clients: move your inactive files, delegate, prioritise and organise so that all work is being diligently progressed at the right level

- Talk about the benefits and value to your client before price; know your value and self-worth and the difference you are making to your clients’ lives. Price work appropriately, taking into account this value, your differentiators, tangible factors (size, complexity, etc), intangibles (notably, is the client a pain?) and a cushion

- On this point, and as highlighted above, get your estimates right. An estimate for 3 hours’ work at £300 per hour is NOT £900 – it must embed all of the above and allow you a comfortable cushion so that you are not having to constantly revise estimates

- Make case notes, illustrating your strategic thinking and actions on a case. These protect you and are chargeable

- Put in place a ‘this is how we work’ meeting with new clients to set out the boundaries and rules of engagement – and, critically, to sift them out or raise prices if you detect that they may be difficult or cause additional work

- Always charge extra for urgent work, out-of-hours work and particularly complex or high value work (and work outside scope); there is no harm in having a range of hourly rates

- Do your chargeable work in blocks in the morning – and within that focus on one matter at a time, rather than running from matter to matter. Impose client and colleague interruption embargos. Put in place a client bounce-back email telling them that, in the interests of client care, you only check your emails at certain times of day; this reduces email traffic and allows you to get on with your work (note that is rather nuanced, so please feel free to contact me for more details)

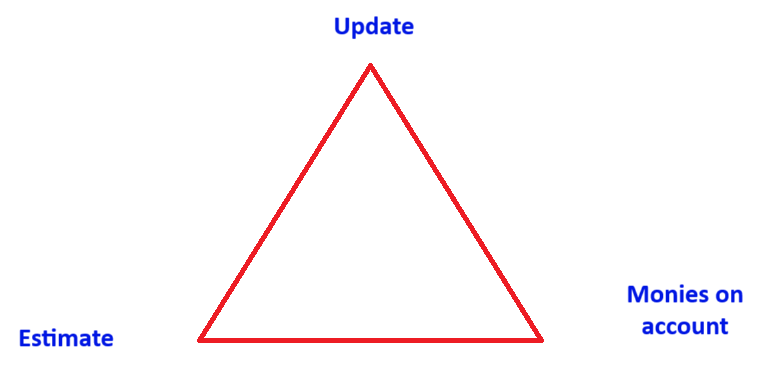

Use my magic triangle method

- Update the client on case progress, what you have achieved and what is coming next and why – impart benefits and value of what you have done

- Give them an estimate accordingly for the next phase of work

- Ask for a matching payment of monies on account

This reduces debt and makes billing at month end a purely administrative task

It goes without saying that you must record all your time, bill all your time and get paid quickly – do not discount or shave at any stage

- Keep a time and motion diary to identify where you are losing time and efficiency; and think about TPDO – teamwork, prioritisation, delegation and organisation. There are 8 hours in a working day: what are you doing with the non-chargeable time?

- As mentioned above, know your self-worth and value to the client and do not be afraid to charge properly. You have years of knowledge, skills and experience and are helping clients to improve their lives by delivering solutions to their problems. Not just anyone can do this

- Make a to-do list the night before and colour-code urgency of tasks so that you know exactly what to focus on. Not all important tasks are urgent. Most are neither, but we tell ourselves that they are and then cannot see the wood for the trees

- Do not leave your time recording until the end of the day – have a pad by your side and record units/minutes contemporaneously, then add onto the system at the end of the day. You will forget what you have done otherwise

- Do not offer free long consultations: a trained paralegal or PA should deal with new enquiries, impart value and funnel them into a paid-for consultation. This will result in more better-quality clients who want to pay you

- Don’t assume that tasks can only be recorded as a certain limited amount of time because “that’s how long it takes / should take / is allowable / it took me too long / it would have taken someone senior less time.” The most common example is 1 unit for emails, even when drafting is involved. The time taken is the time taken and must be recorded. Under-recording time is damaging and a vicious circle. It may help to put in place write-off protocols at your firm, eg approval needed for reductions of more than a certain amount

- Do not discount, under-estimate or over-service

In conclusion, actively consider cashflow, billing, estimates, fees, and time recording. Make sure you charge properly and get paid well—without discounts—for the value you bring to your clients.

Jay Sahota

Jay Sahota