Probate Genealogy in the UK: Myths and Misconceptions

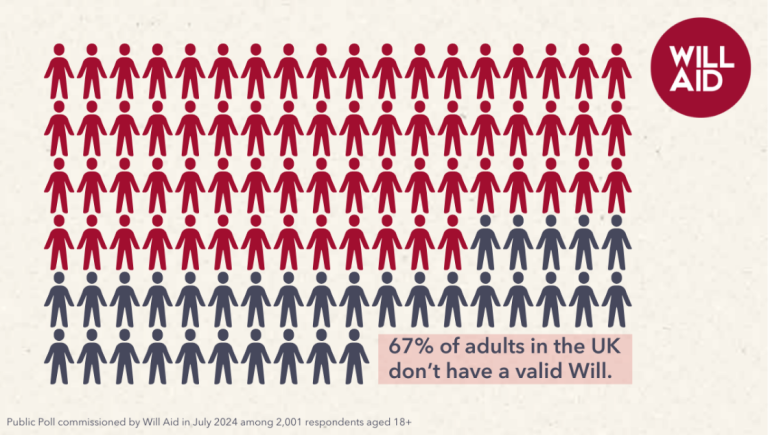

Probate genealogy is a specialized field focused on locating heirs when someone dies intestate (without a will), often misunderstood despite its significance. In this article Callum Emmerson of Blanchards Inheritance debunks some of those common myths for us.